I posted on the parity possibilities a few days ago in this thread:

https://perb.cc/vbulletin/showthread.php?t=102694

I do think we will reach parity but let me explain why & as Angel has eluded to, it is not really a good thing.

We are unfortunately just at the tip of the iceberg in this economic meltdown.

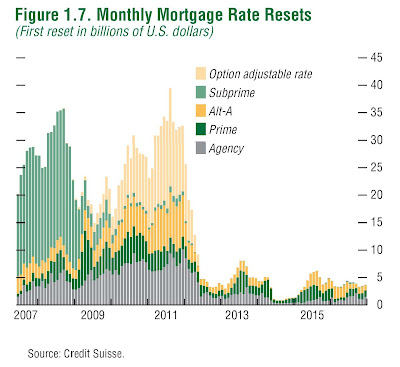

The reason I say that we will see parity in the two currencies is that the US has another wave of loans which are going to hit the market & default when the rate resets per the mortgage terms.

These are called Alt-A loans & they are the ones that buried Lehman Brothers in one fell swoop.

There also is Option adjustable loans to consider which are pervasive in the market.

Take a look at this chart:

http://bp3.blogger.com/_pMscxxELHEg/RxzD0s_7EYI/AAAAAAAABB4/ljDSXZhMG3o/s1600-h/IMFresets.jpg

Although many of the homeowners in the 2009 to 2011 reset periods will refinance (if they can), this shows that the problems in housing will linger for several years. What is especially concerning is all these Option ARM resets in 2010 and 2011. Most of these homeowners are selecting the minimum payments (negatively amortizing) and many homeowners will be upside down when the ARM resets.

The Obama stimulus plan is sending billions of dollars to try & head off stagflation & assist these holders of the "creative financing" that was the brainchild of Greenspan & the Clinton gang back at the end of the 90`s & turn of the millennium.

-------------------------------------------------

Greenspan stated his beliefs on this back in 2004:

http://www.usatoday.com/money/economy/fed/2004-02-23-greenspan-debt_x.htm

Read this for more background:

http://www.bankrate.com/brm/story_content.asp?story_uid=24201&prodtype=mtg

--------------------------------------------------

back to my original points;

So, what all this means is that we are in for wave after wave of rate resets that will result in homeowners not being able to pay their mortgage.

This on top of massive numbers of unemployed & consumerism spiraling the drain.

Once the attempts to throw money at this black hole fail we will see the desperation of the Obama administration & the rest of the world will lose faith in Obama with America on his shoulders, then the beleaguered Dollar will wane.

When that happens Canada will enjoy relative strength with the Loonie.

This will be a temporary celebration though as the effects of a high Loonie will make trade with Canada unattractive & let`s face it, we depend on the sale of our goods & services to America & the rest of the world for our survival.

Harper & Jim Flaherty our Finance Minister will, if they are smart, do everything they can to reduce the value of the loon against the Buck, Peso & Yuan.

We would do best to have a 83 cent Loonie. (1.205 for a Buck)

Try Gold before it gets to $1100 or better yet copper & other precious metals.